See also

10.01.2025 09:13 AM

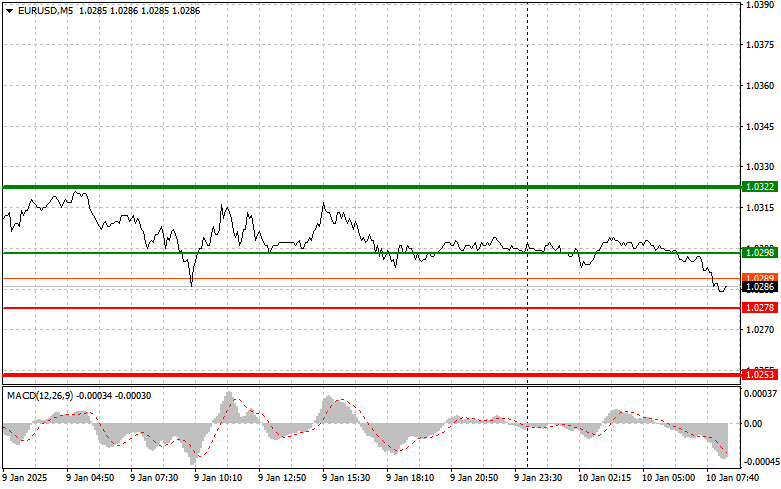

10.01.2025 09:13 AMThe test of the 1.0317 level in the second half of the day occurred when the MACD indicator had significantly risen above the zero mark, which limited the pair's upward potential. For this reason, I chose not to buy the euro, and no other entry points presented themselves.

Yesterday, comments from Federal Reserve officials supported demand for the U.S. dollar. Michelle Bowman stated that inflation remains high and sees risks of its resurgence. She believes that December's rate cut should be the last until the situation with rising prices stabilizes. Patrick Harker also noted that it will take longer than expected to bring inflation down to 2% and suggested that the Fed should consider taking a small pause amid the current uncertainty.

This morning, there is no significant data from the Eurozone, but figures regarding changes in France's consumer spending, industrial production, and Italy's retail sales should not be overlooked. Only very weak data could trigger a sell-off for the euro ahead of the U.S. labor market reports.

For today's intraday strategy, I will primarily focus on implementing Scenarios #1 and #2.

Scenario #1: Buy the euro at around 1.0298 (green line on the chart), targeting a rise to 1.0322. At 1.0322, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30–35 pips from the entry point. A bullish scenario for the euro is only plausible in the first half of the day if positive data is released. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0278 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward reversal. Expect a rise to the 1.0298 and 1.0322 levels.

Scenario #1: Sell the euro after reaching the 1.0278 level (red line on the chart). The target will be 1.0253, where I plan to exit the market and buy in the opposite direction, expecting a movement of 20–25 pips in the opposite direction from the level. Pressure on the pair can resume at any moment. Important: Before selling, ensure the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0298 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. Expect a decline to the 1.0278 and 1.0253 levels.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 145.20 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downside potential. However, this did not prevent selling the U.S. dollar

The price test at 1.2946 occurred when the MACD indicator moved significantly above the zero line. However, the test coincided with the release of U.S. data that justified

The price test at 1.1105 occurred when the MACD indicator had already moved significantly above the zero line. However, after the release of key U.S. data, this did not prevent

Ferrari F8 TRIBUTO

from InstaTrade

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.