See also

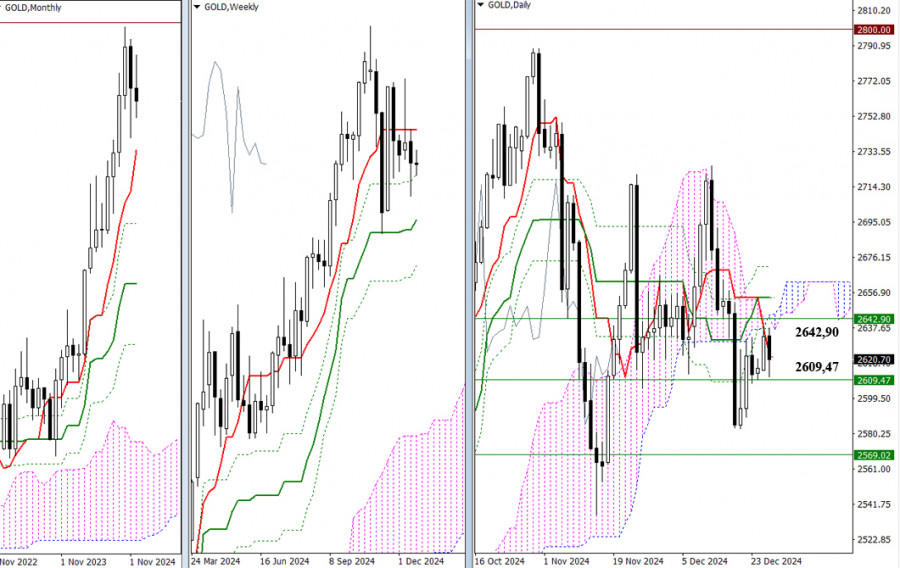

The holiday season continues to impact the market, balancing opportunities and participant activity. Over the past week, the price range has been narrow. Current support is established at the weekly Fibonacci Kijun level of 2609.47, while resistance is marked by the daily cloud at 2637.37. For the last few days, the center of attraction has been the daily short-term trend at 2623.39.

With just two days remaining in December, we are approaching the end of 2024. Significant market activity may remain subdued in the near term and into the first few days of January. Nevertheless, we can identify key levels that traders might consider for any potential directional movements.

The interests of bearish players during the market decline will focus on breaking below the nearest weekly support level at 2609.47, aiming to update the recent low of 2582.84 and test the weekly mid-term trend, which is projected to rise to approximately 2569.02 when trading opens. Currently, bearish players are contending with the resistance posed by the daily cloud, which will be bolstered by the weekly short-term trend at 2642.90 when trading begins on Monday. If there is a breakout and consolidation in the bullish zone relative to the daily cloud, bearish players will also eliminate the daily Ichimoku cross. It is important to note that within a few days, the upper boundary of the cloud will be at the 2662.89 line, while the current cross levels are positioned at 2654.20 and 2671.05.

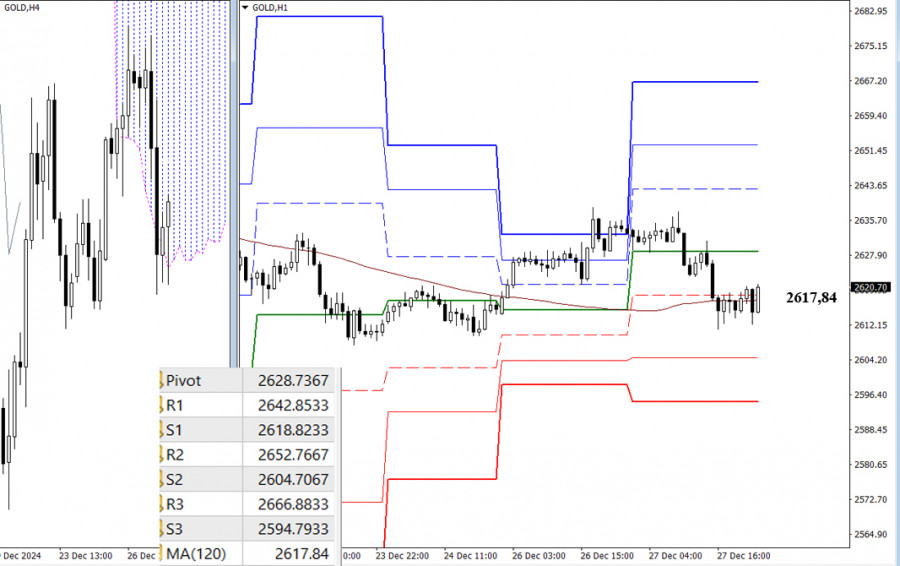

Currently, on lower timeframes, the market is focused around the weekly long-term trend level of 2617.84, which indicates the prevailing balance of power. The bullish advantage remains intact as long as the price stays above this trend. Daily resistance levels from classic Pivot Points serve as potential intraday targets. However, if the price moves below the trend and reverses downward, this could shift the balance in favor of the bears, leading to a continuation of the decline. Intraday bearish targets can be identified through classic Pivot Point support levels.

Pivot Point values are updated daily, and new levels to monitor for the first trading day of the upcoming week will be available upon the market's opening.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.