See also

10.12.2024 01:13 PM

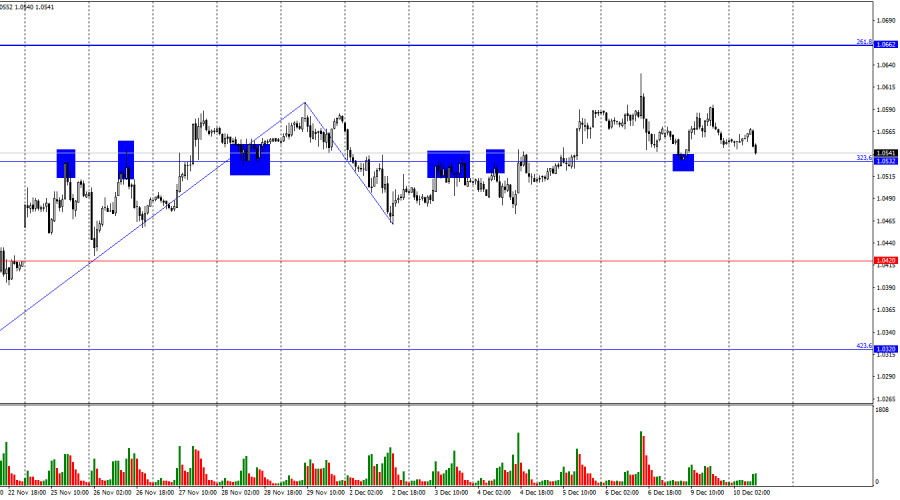

10.12.2024 01:13 PMOn Monday, the EUR/USD pair rebounded from the 323.6% retracement level at 1.0532, showed some growth, and then returned to the same level. A new rebound from this level today could lead to another rise in the euro, but a close below it seems more likely, with further declines toward the 1.0420 level. Bulls are losing market momentum, though their grip was weak to begin with.

The wave structure is straightforward. The last completed downward wave did not break the previous low, while the last upward wave barely broke the previous peak. As a result, the pair has started forming a "bullish" trend, which appears weak and may end this week. A drop below 1.0461 would invalidate the current "bullish" trend.

There was no significant news on Monday, but several key factors this week could trigger a new dollar rally:

Based on these factors, I believe the bulls have tried but failed. A new decline in the pair and a corresponding dollar rally are likely. Tomorrow's U.S. inflation report could influence this scenario, but I think even low inflation won't strengthen the bulls significantly. Weak inflation might work against the dollar, but at most, it could trigger another unconvincing "bullish" wave while the "bearish" trend remains intact.

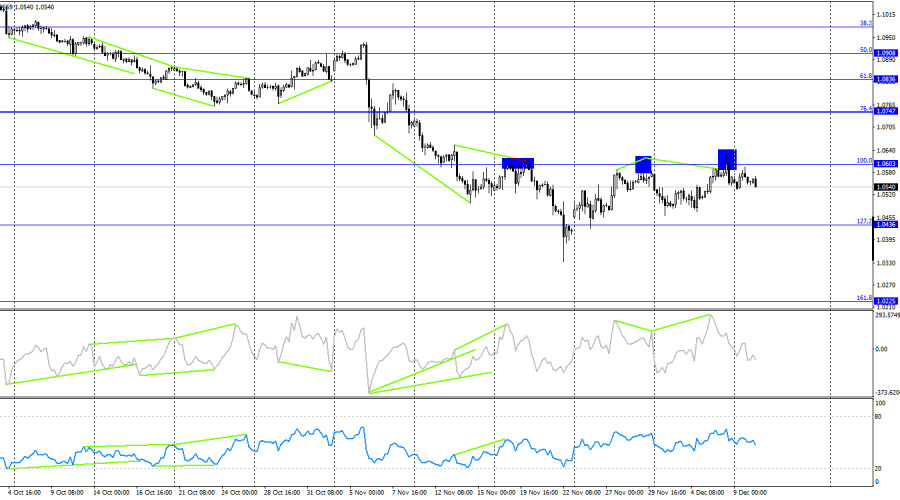

On the 4-hour chart, the pair rebounded twice from the 100.0% retracement level at 1.0603, initiating a new decline toward the 127.2% Fibonacci level at 1.0436. A "bearish" divergence on the CCI indicator also supports downward movement. Consolidation above 1.0603 would allow for continued growth toward the next retracement level at 76.4% (1.0747), but my main scenario is further declines.

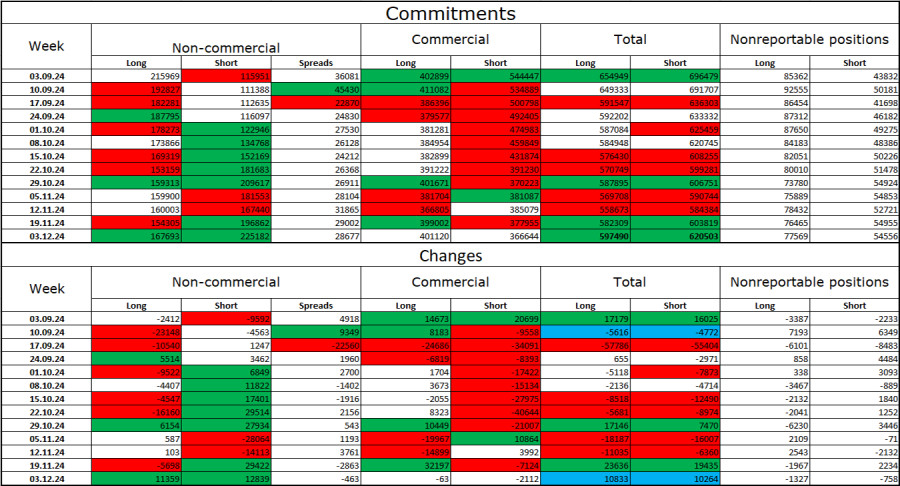

During the last reporting week, speculators opened 11,359 long positions and 12,839 short positions. The sentiment among the "Non-commercial" group remains "bearish," indicating further declines for the pair. The total number of long positions held by speculators now stands at 168,000, while short positions total 225,000.

For 12 consecutive weeks, major players have been reducing their exposure to the euro. This suggests the formation of a new "bearish" trend. The primary driver of the dollar's decline—expectations of FOMC monetary policy easing—has already played out. The market no longer has a compelling reason to sell off the dollar, and the dollar's rise remains more likely. Graphical analysis also supports the start of a long-term "bearish" trend. As such, I am preparing for an extended decline in the EUR/USD pair.

On December 10, the economic calendar contains only one significant entry. The informational background's impact on market sentiment may be minimal.

Fibonacci Levels:Fibonacci levels are drawn from 1.1003–1.1214 on the hourly chart and from 1.0603–1.1214 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Our trading plan for the coming hours is to sell gold below 3,224, with targets at 3,203 and 3,156. We should be alert to any technical rebound, as the outlook

On the 4-hour chart of the Crude Oil commodity instrument, the Inverted Head & Shoulders pattern and Bullish Pattern 123 and Divergence between the #CL price movement and the Stochastic

With the appearance of Divergence from the Stochastic Oscillator indicator with the XPD/USD price movement on its 4-hour chart and the appearance of a Bullish 123 pattern followed

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance that

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be released

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.