See also

04.12.2024 07:30 AM

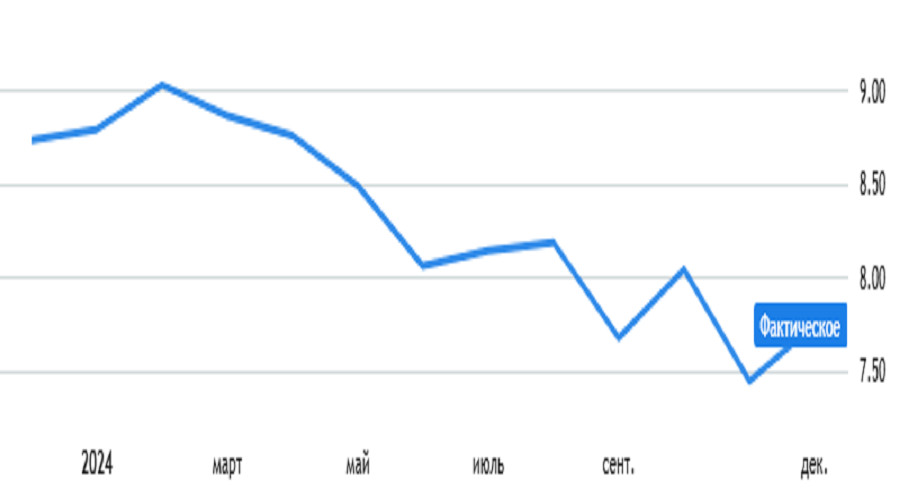

04.12.2024 07:30 AMThe number of job openings in the United States was expected to decrease by 63,000 but increased by 372,000. However, it's difficult to draw any conclusions from this data because the reasons behind it remain unclear. It could indicate either the creation of new jobs or a surge in voluntary resignations by employees. Unsurprisingly, the market showed no reaction and continued consolidating around previously established levels.

Today promises to be a busy day. First, focus on the Eurozone Producer Price Index (PPI), expected to decline from -3.4% to -3.5%. This suggests that the inflation growth indicated in preliminary estimates is temporary and will likely resume its downward trend soon. Consequently, the euro may come under pressure.

Later, during the U.S. trading session, the direction of movement could shift, with quotes potentially rebounding to current levels. This would be influenced by U.S. employment data, which is forecasted to grow by 180,000. Considering the size of the population and its growth rate, this is insufficient to maintain labor market stability. In other words, there is a risk of rising unemployment, which could put pressure on the dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.