See also

23.08.2024 10:21 AM

23.08.2024 10:21 AMData on business activity indexes in the Eurozone, the UK, and the United States were published on Thursday. Nearly all indexes showed growth, but market attention was drawn to other events. The focus shifted to the news flow related to the beginning of the annual economic symposium in Jackson Hole, which traditionally influences monetary policy direction for the coming year. This year's central theme is "Reassessing the Effectiveness and Transmission of Monetary Policy."

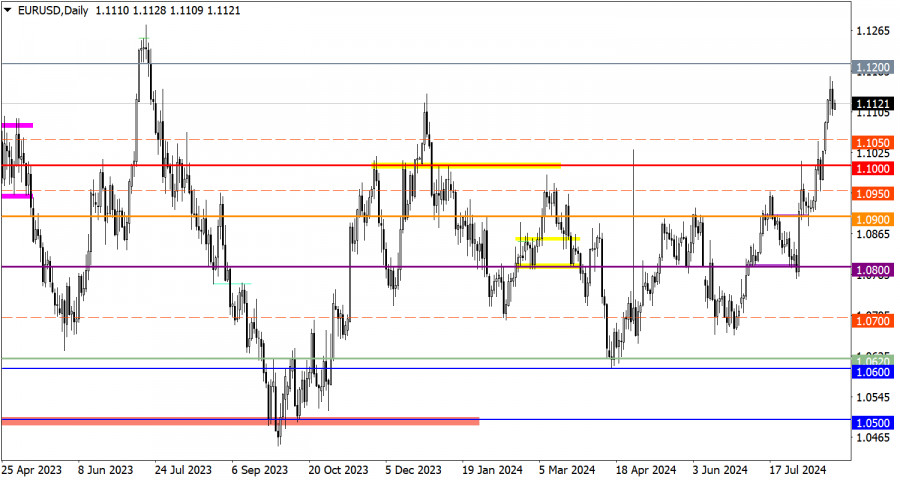

The EUR/USD pair experienced a slight pullback after breaking the local peak from December 2023. However, this movement does not disrupt the general upward trend.

The GBP/USD pair also underwent a correction, but the extent was so minor that the price has almost fully recovered the volume of long positions.

The economic calendar for August 23 includes data on the US construction sector. However, the market's primary focus will be the Federal Reserve head's speech at the annual Jackson Hole symposium. Fed Chair Jerome Powell is expected to provide specific guidance regarding the central bank's upcoming actions, making this information critically important for traders.

In the context of the current regrouping of trading forces after the correction, there are prospects for an increase in the volume of long positions in the euro. The quotes might aim for the peak of the current uptrend around 1.1280. In an alternative scenario, if the pullback continues, a return to the level of 1.1000 is possible.

The British pound's uptrend will strengthen if the quote remains above 1.3150, which could lead to further appreciation. However, if this condition is not met, the risk of a correction to the 1.3000 level remains.

Candlestick Chart: This chart type displays graphic rectangles in white and black with lines at the top and bottom. A detailed analysis of each candlestick reveals its characteristics relative to a specific period: opening price, closing price, highest price, and lowest price.

Horizontal Levels: These are price coordinates where the price might experience a halt or reversal. In the market, these levels are referred to as support and resistance.

Circles and Rectangles: These are highlighted examples where the price reversed in the past. The color highlighting indicates horizontal lines that may exert pressure on the quote in the future.

Up/Down Arrows: These are indicators of the potential future direction of the price.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flat

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week once

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbelief

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overall

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.