See also

19.07.2024 10:24 AM

19.07.2024 10:24 AMOn Thursday, all investors' attention was focused on the meeting of the European Central Bank at which the regulator, as expected, kept key interest rates at the same level. This decision coincided with the expectations of analysts and market participants. The ECB press release noted that most economic indicators were either stable or declined in June. The ECB also underscored that the financing conditions remain restrictive. At the same time, inflation in the euro area remains high, service inflation is likely to persist in the medium term. Headline inflation is expected to be above the ECB 2% target both this year and next.

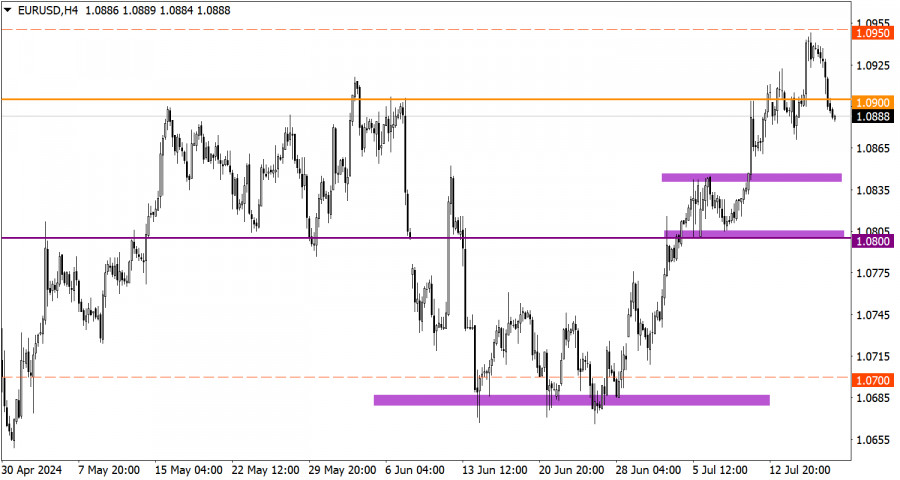

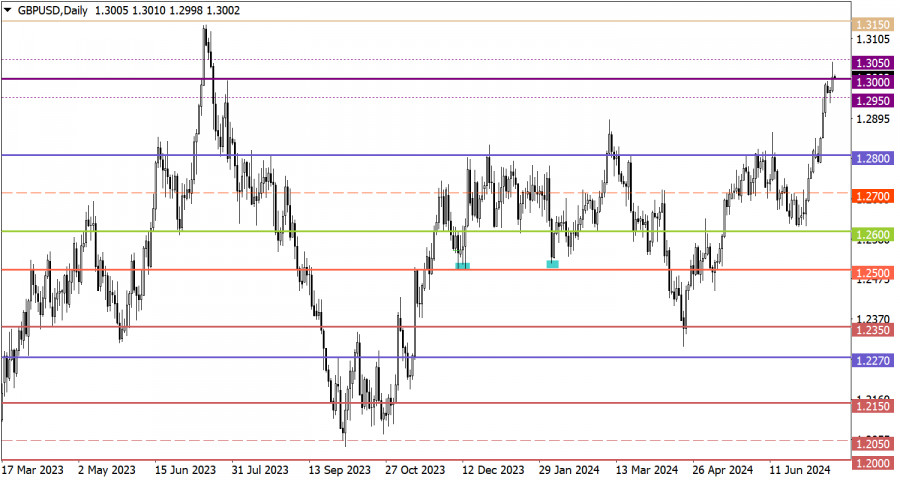

Overview of technical charts on July 18

Traders cut on long positions on the EUR/USD pair within the lower border of the corridor between 1.0950 and 1.1000. As a result, the price pulled back which led to a decline below 1.0900.

The GBP/USD pair also saw a reduction in the volume of long positions when the price touched the psychological level of 1.3000. As a result, the instrument had a pullback, as a result of which the price dropped below 1.2950.

Economic calendar on July 19

During the early European session today, data on retail sales in the UK was published. The retail sales volume shrank by 1.2% in June after growing by 2.9% in May. The reading is worse than forecasts for a fall of 0.4%.

If EUR/USD settles below 1.0900 by the end of the week, the instrument may continue the current pullback. Otherwise, a local weakening of the euro could attract buyers, leading to a new bullish stage.

The ongoing pullback could intensify if the price settles below 1.2950 by the end of the week. However, if the price rebounds above this level, we expect GBP/USD to oscillate in the corridor of 1.2950 to 1.3050.

The candlestick chart type consists of graphic rectangles in white and black with lines at the top and bottom. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time period: opening price, closing price, maximum and minimum price.

Horizontal levels are price coordinates relative to which a price may stop or revered its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price developed. This color highlighting indicates horizontal lines that may put pressure on the price in the future.

Up/down arrows are guidelines for a possible future trajectory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flat

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week once

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbelief

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overall

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.