See also

11.06.2024 01:00 AM

11.06.2024 01:00 AMThe US labor market data for May turned out to be significantly unexpected – nonfarm Payrolls in the US rose 272,000 in May (forecast was +185,000), average hourly earnings rose by 0.4% (previous month +0.2%), and the labor force decreased by 250,000. As a result, yields surged, and the dollar firmly strengthened against all major world currencies.

The data was both unexpected and overly contradictory. Strong job growth was recorded alongside a decline in labor force participation and a rise in unemployment. In addition, both ISM reports showed a decrease in employment, which is very strange in itself and suggests either errors in calculations or data manipulation ahead of the upcoming US presidential elections.

The data indicates that the US labor market remains resilient despite all the Federal Reserve's efforts. The threat of renewed inflationary pressure remains high. The non-farm payrolls contradict other indicators that show a slowdown in the US economy.

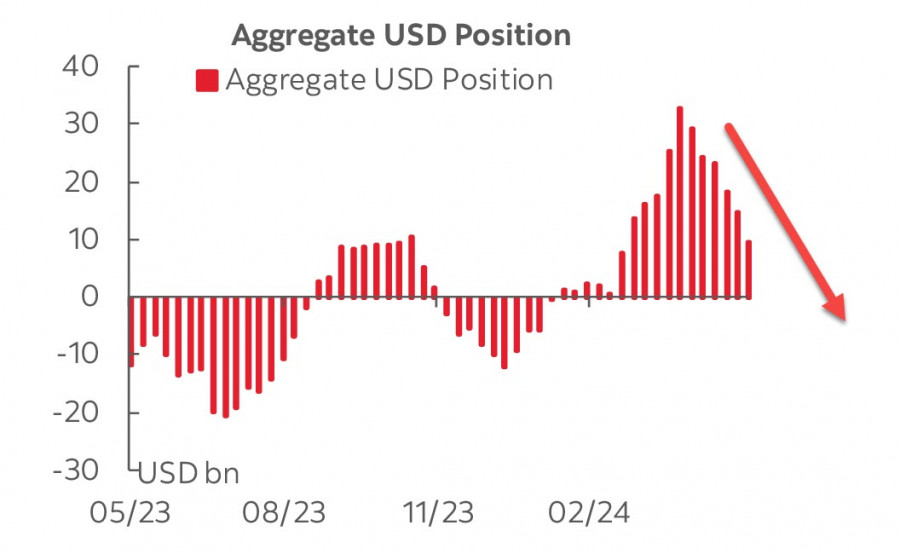

The CFTC report brought no surprises – the total long position on the US dollar against major world currencies decreased by $4 billion to $10.6 billion for the reporting week.

Long positions have been declining for six consecutive weeks, and there are no signs that investors might start buying the dollar again anytime soon. Investors did not expect such strong non-farm payrolls, and now much depends on the inflation report due on Wednesday, right before the Federal Reserve meeting.

The Fed is expected to leave interest rates unchanged. As of Thursday, markets were assessing an 80% probability of the first rate cut in September, but after the non-farm payrolls report, expectations for the first rate cut shifted to November, with the probability now estimated at around 45%. This makes the outlook for the dollar significantly more hawkish.

Last week there was another unexpected report – the ISM for the services sector. The ISM index rose from 49.4 to 53.8, which clearly contradicts the emerging picture of a slowing US economy. In fact, the May PMI and ISM indices showed a weakening balance of industrial orders and inventories, and the number of job vacancies signaled a decline in labor demand. Growth in bank lending has stabilized below pre-pandemic levels, as tight monetary policy continues to have a negative impact.

As of Thursday, markets saw no signs of an overheating US economy, but the ISM services sector report and the non-farm payrolls have significantly altered forecasts. Now we need to wait for Wednesday to see both the inflation dynamics and any changes in the Fed's forecasts. Two opposite scenarios are possible here. If inflation shows high resilience, considering the strong ISM and labor market data, the market will inevitably conclude that the economy is overheating, and the dollar will maintain higher yields, continuing its purchases. However, if inflation shows a minor decline, which is quite logical given that the price components in both ISM reports showed a decrease, the non-farm payrolls will be seen as a one-off spike that does not affect the overall picture, and the dollar will start getting weaker again.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Only a few macroeconomic events are scheduled for Friday, but some are quite significant. Naturally, the focus is on the U.S. NonFarm Payrolls and unemployment rate, yet it's also important

On Thursday, the GBP/USD currency pair continued to decline. The dollar had strengthened for three consecutive days—despite having no objective reason. U.S. macroeconomic data has been consistently weak; there were

On Thursday, the EUR/USD currency pair once again traded relatively calmly, but the U.S. dollar failed to show any meaningful growth this time. A little bit of good news goes

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.