See also

04.06.2024 12:41 AM

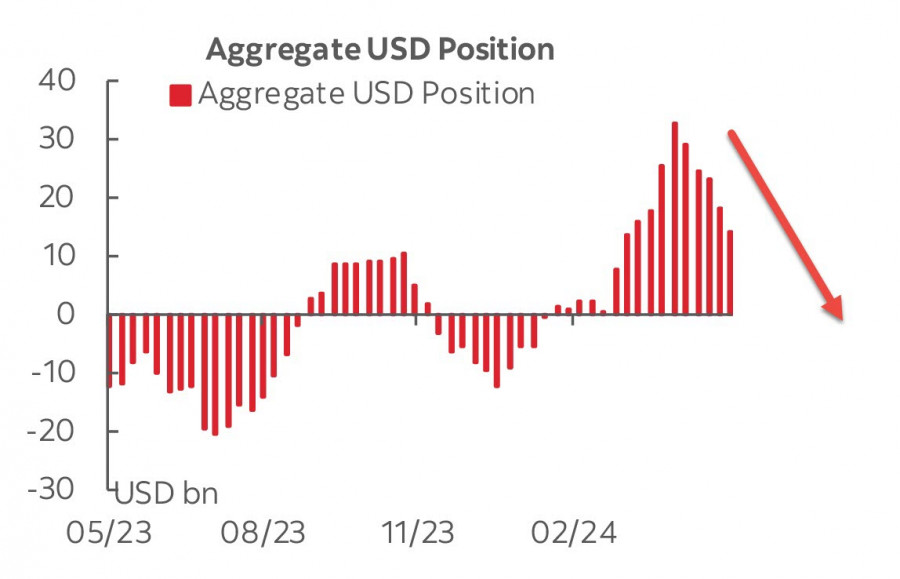

04.06.2024 12:41 AMThe net long USD position decreased by $3.8 billion to $14.8 billion over the reporting week, marking the fifth consecutive week of decline. The bearish bias remains intact, and the sell-off trend shows no signs of slowing down.

It is notable that the dollar sell-off is happening against the backdrop of nearly unchanged forecasts for the Federal Reserve's rate. As recently as mid-April, the Fed-funds futures were expecting the US central bank to cut its benchmark rate in September, with the second round expected around December or January of the following year. By the end of April, the futures market showed a steady growth in demand for USD.

Currently, expectations remain almost the same, with the first rate cut expected in September and the second in December or January. However, the dollar continues to be sold off. Apparently, a new factor has emerged, changing the forecasts.

This factor is based on growing fears that the US economy is at risk of a recession.

US economic growth for the first quarter was revised down from 1.6% rate to 1.3% due to soft consumer spending. Americans' household savings rate is declining.

Another indicator is the decline in the real estate market. Existing home sales in the US declined 1.9% month-over-month to a seasonally adjusted annualized rate of 4.14 million units in April 2024, which is almost equivalent to the worst period during the financial crisis of 2008-2011. Pending US home sales have dropped to a record low, about 15% lower than in 2008/09, and when adjusted for population growth, more than a quarter lower.

Moreover, the decline in consumer spending has had little impact on inflation. The Personal Consumption Expenditures (PCE) price index, which accounts for the average amount of money consumers spend, rose by 0.3% in April, which is 2.5 times the historical average.

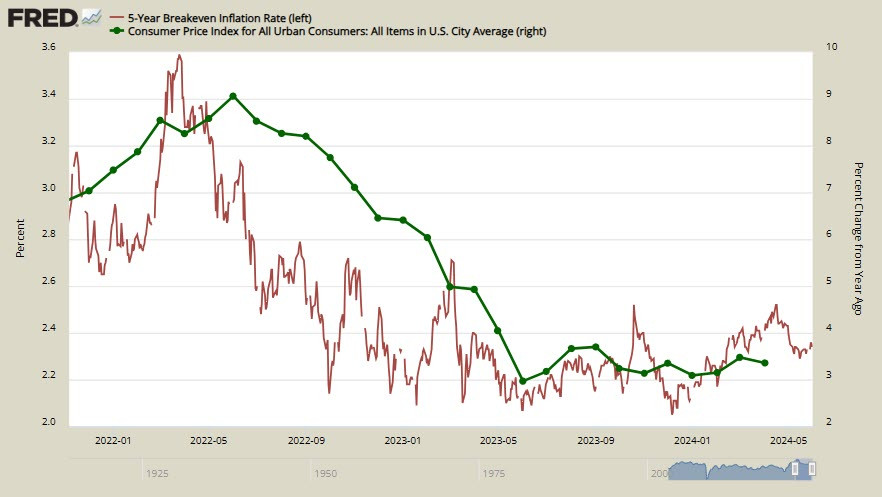

The yield on 5-year TIPS, which is calculated with an inflation adjustment, reached a low on December 6th and has since resumed growth. This is a fairly accurate indicator of inflation sentiments in the business environment, and it is not decreasing. Given that the calculation of the annual inflation rate in May will start considering last year's low base, it can be assumed that US inflation may surprise everyone with its growth in the coming months.

If the risk of a recession becomes apparent, the government will be forced to launch a new stimulus program. However, the budget deficit as a percentage of GDP is already at its highest since 2012, excluding the COVID-19 years of 2020/21. The launch of a stimulus program will increase the budget gap to $3-4 trillion, and this huge amount of securities will have to be sold to someone. Obviously, the Fed is the main buyer, which implies a return to QE.

If events unfold this way, the dollar will become weaker. It is likely that global investors are fearing a similar scenario. Regardless of how accurate our assumptions are, we must pay attention to their actions, which signal increasing volumes of USD sales.

The US dollar remains under pressure, and there are currently no reasons to expect a bullish pivot.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains

A relatively large number of macroeconomic events are scheduled for Friday, but none are expected to impact the market. Of course, we may see short-term reactions to individual reports

The GBP/USD currency pair also traded higher on Thursday. As a reminder, macroeconomic and traditional fundamental factors currently have little to no influence on currency movements. The only thing that

The GBP/USD currency pair also showed strong growth on Thursday, although not as strong as the EUR/USD pair. The pound gained only around 200 pips—which isn't a considerable move under

The CPI report released on Thursday showed weaker-than-expected inflation. The market responded accordingly: the U.S. dollar came under renewed pressure (the U.S. Dollar Index fell into the 100.00 range)

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.