See also

14.05.2024 12:49 AM

14.05.2024 12:49 AMThe euro continues its bullish correction for the fourth consecutive week, but there is uncertainty regarding the sustainability of this movement. In the absence of economic news, the euro has not found an impetus for growth, despite the efforts of some European Central Bank representatives who have commented on recent changes in inflation, employment, and economic recovery.

The minutes of the ECB meeting published on Friday showed increased confidence that inflation is on track back to 2% and it also confirmed rate cut intentions for June. Some ECB members were ready to cut rates as early as April, but the minutes suggested a preference for June if "...additional evidence received by then confirmed the medium-term inflation outlook embedded in the March projections." If the market becomes confident in a rate cut in June, the euro will likely fall against the dollar.

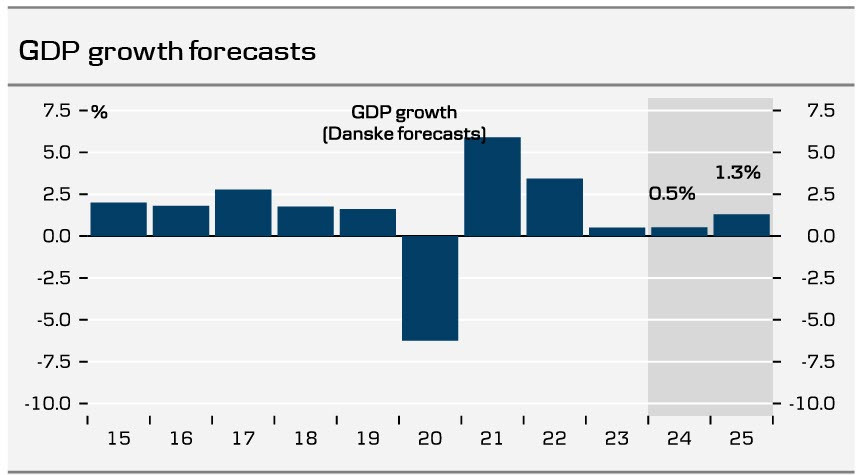

The second estimate of GDP for the first quarter will be published on Wednesday. The initial estimate was 0.3%, marking the first quarter of growth since the second quarter of 2023 and the strongest since the third quarter of 2022. This fairly confident recovery was a surprise following a very weak 2023 (only the COVID-affected 2020 was worse). If the initial estimate does not become worse, the euro may have grounds to correct higher. Supporting a "good" scenario is the rise in April's PMI, particularly in Germany, which left the negative territory for the first time since June 2023.

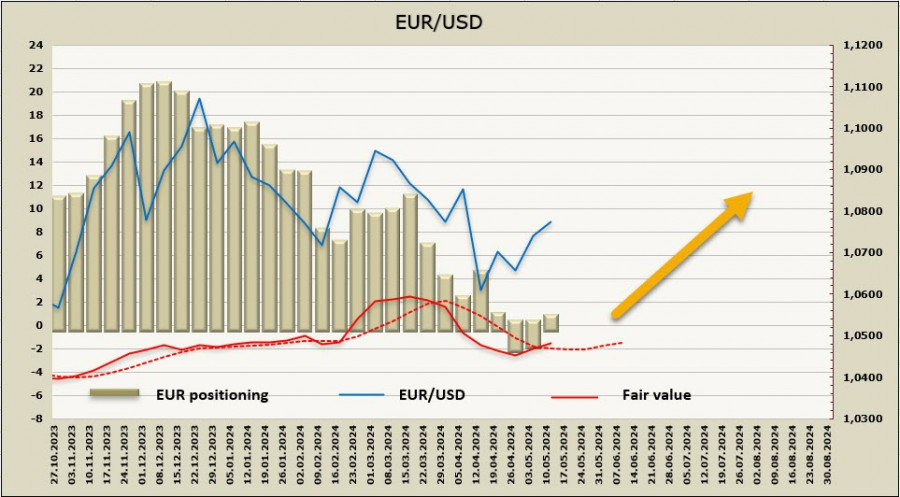

The weekly change in the euro amounted to +1.5 billion, the net short position was liquidated and a cumulative long position of 0.6 billion was formed. A neutral position; a fragile equilibrium has been established after large-scale closures of long positions on the euro. However, the report marked large volumes of euro purchases for the second consecutive week. The price has moved above the long-term average.

A week ago, we suggested that the EUR/USD pair has a high chance of rising further. The euro is trading near the upper boundary of the bearish channel. In the absence of a clear driver, the pair traded in a sideways range last week, with the nearest resistance at 1.0810/20 holding for now. However, the chances of successfully breaking through this resistance seem to have increased. The next target is 1.0980, and we expect stronger movements to start after the release of the US inflation report on Wednesday.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.