See also

27.07.2022 01:39 PM

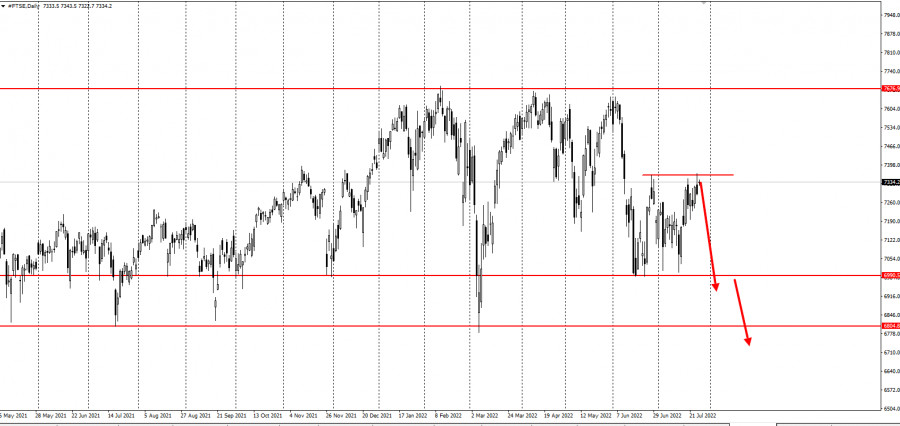

27.07.2022 01:39 PMThe International Monetary Fund said the UK will experience the slowest growth next year because of double-digit inflation and rising interest rates. Their latest outlook indicated that the global economy is currently fragile, so sliding into recession is possible. In fact, the FTSE 100 index already shows downside potential.

Accordingly, the IMF downgraded their rating for the UK in both 2022 and 2023, reflecting an increase in the forecast for peak inflation from 7.8% to 10.5%.

With regards to the battle over the seat of prime minister, Liz Truss accused her rival, Rishi Sunak, of pushing the economy into recession through tax increases. Sunak, meanwhile, accused Truss of planning to spur inflation, even though it is already at a 40-year high of 9.4%.

Sky-high inflation has eaten household incomes, causing poverty and the worst cost-of-living crisis in decades. The IMF said wage increases due to low inflation "undermine household purchasing power" and causes a slowdown in growth.

Bloomberg Economics estimates that the Truss tax cut will add 0.6% to 2023 GDP, pushing the UK's growth rate higher than that of France, Germany, Italy and the US. It would also add 0.4% to inflation, which will cause interest rates to rise by another 0.5%. Markets expect UK rates to hit 3%.

The biggest risks to global growth are inflation and rates, as well as the escalation of the war in Ukraine, which will drive up energy and food prices. A tight labor market will allow workers to earn higher payouts, while higher interest rates could lead countries to shrink.

The IMF has previously said that the UK faces a serious problem on inflation, linked both to high energy prices experienced by Europe and a shortage of jobs.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopolitical

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could make

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.