See also

11.05.2022 01:49 PM

11.05.2022 01:49 PMUntil the ECB takes concrete steps towards tightening its policy, the euro will remain under strong pressure, and the EUR/USD pair is under threat of a new fall below 1.0500, towards euro parity with the dollar.

EUR/USD is declining not only due to the weak euro but also to the strengthening dollar.

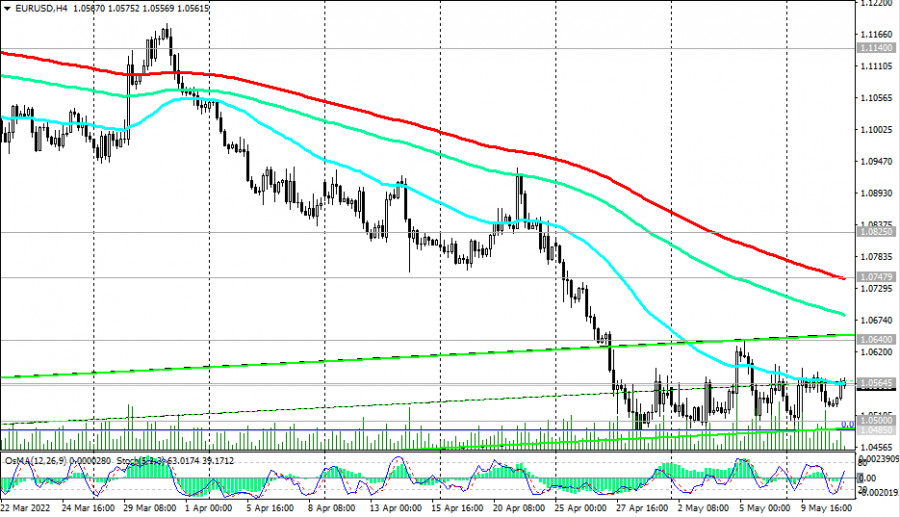

In terms of technical analysis, a strong negative impulse prevails. In particular, the Stochastic on the monthly chart of the pair has been in the oversold zone since October 2021, not wanting to leave there, which indicates a strong trend.

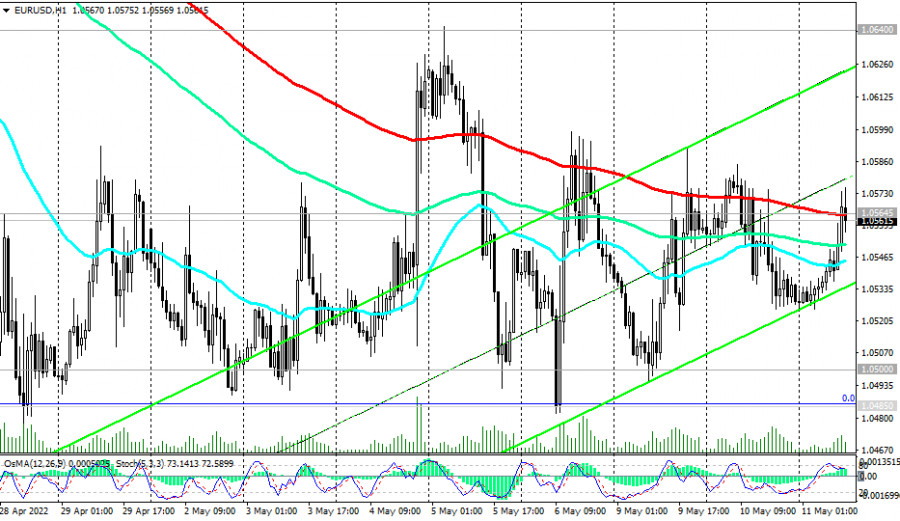

And yet, on the lower time frames (daily, 4-hour, 1-hour), technical indicators switched to the side of the buyers, signaling the possibility of continuing the upward correction.

Its immediate targets are resistance levels 1.0748 (200 EMA on the 4-hour chart), 1.0825 (50 EMA on the daily chart), and the signal for this upward movement will be a breakdown of resistance levels 1.0565 (200 EMA on the 1-hour chart), 1.0640 (local top).

In our previous review on 04/28/2022, we noticed that the price dropped to a strong support level of 1.0500, near which there were bounces three times (in February and November 2015, as well as in January 2017), and the price turned up. As a matter of fact, that is what happened.Nevertheless, further growth (above the resistance levels of 1.0748, 1.0825) is unlikely. Below the key resistance levels 1.1245, 1.1285, 1.1500, 1.1720, EUR/USD is in the zone of a long-term bear market, and "a breakdown of the support levels at 1.0500, 1.0470 will confirm our assumption" about further decline in the pair. In the current situation, short positions remain preferable.

Support levels: 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Resistance levels: 1.0565, 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285

Trading Tips

Sell Stop 1.0520. Stop-Loss 1.0610. Take-Profit 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Buy Stop 1.0610. Stop-Loss 1.0520. Take-Profit 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flat

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week once

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbelief

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overall

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade upward on Thursday despite the absence of any objective reasons for such movement. There were

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.