See also

12.01.2022 09:45 AM

12.01.2022 09:45 AMBased on the economic calendar, there will be two important publications today, which may affect the movement of the market. US Core CPI will be released at 13:30 Universal time, followed by a report on data on crude oil inventories in the United States at 15:00 Universal time.

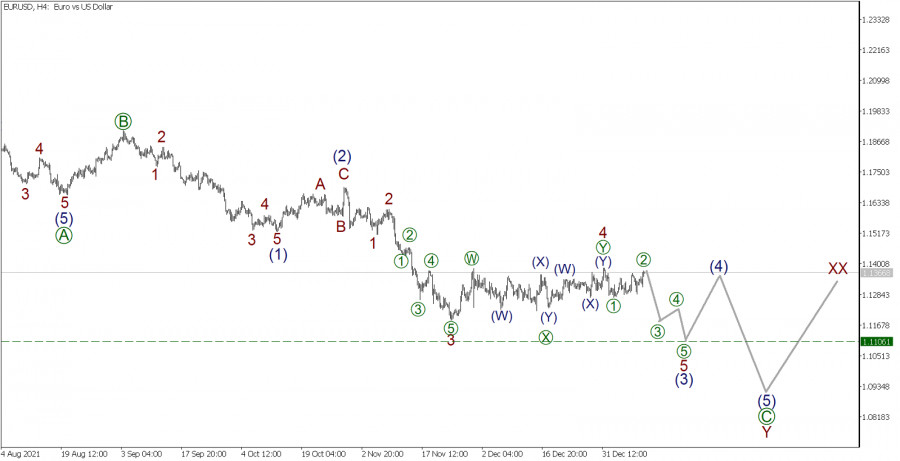

EUR/USD, H4 timeframe:

It is assumed that the development of a large triple zigzag will continue, which will consist of WXY-XX-Z sub-waves.

Earlier, we are in the middle part of this corrective pattern, that is, in the sub-wave Y. It is highly possible that wave Y will take the form of a simple zigzag [A]-[B]-[C]. The current chart shows the final part of the bearish impulse wave [A] and the upward corrective wave [B]. The initial part of the last wave [C], which can take the form of a five-wave pulse (1)-(2)-(3)-(4)-(5), can also be observed in the graph.

At the moment, we are in impulse (3), particularly in its final sub-wave 5. Perhaps, wave 5 will represent an impulse, and end at the level of 1.1106.

In this case, a downward movement is expected in the short term, and today's news is likely to strengthen the bears, so it is worth considering opening sell trades in order to take profits at this level.

An approximate outline of possible future movement is shown on the graph.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.