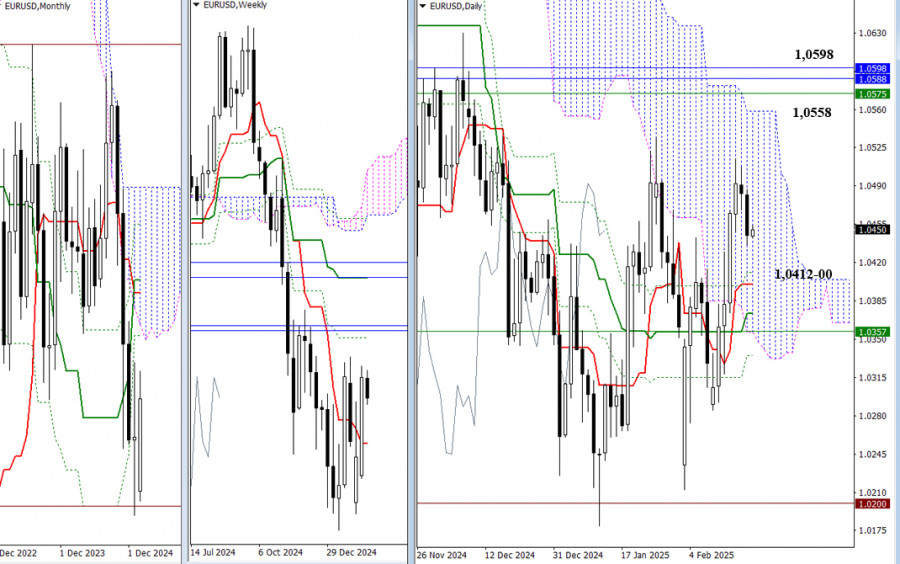

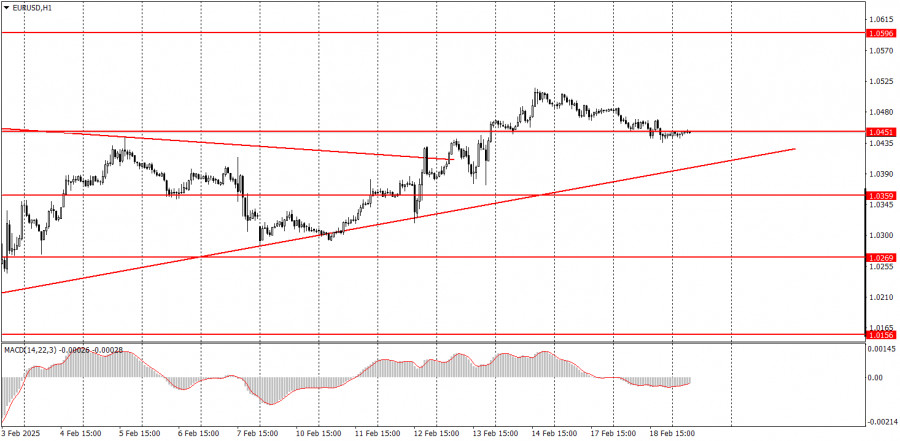

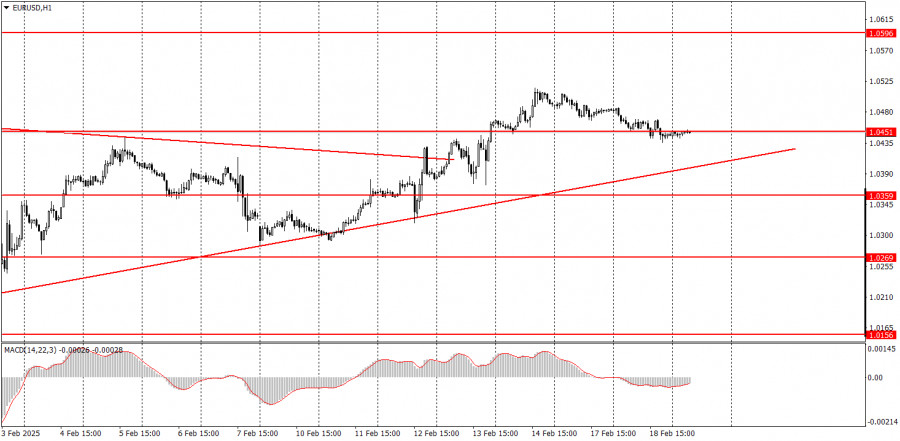

- At the start of the new trading week, bearish players have paused, leading to a daily corrective decline. The daily Ichimoku cross serves as the nearest reference point for this downward correction, with its levels positioned at the boundaries of 1.0411, 1.0400, 1.0373, and 1.0335 today..

Author: Evangelos Poulakis

08:16 2025-02-19 UTC+2

1333

Intraday Strategies for Beginner Traders on February 19Author: Miroslaw Bawulski

08:21 2025-02-19 UTC+2

1288

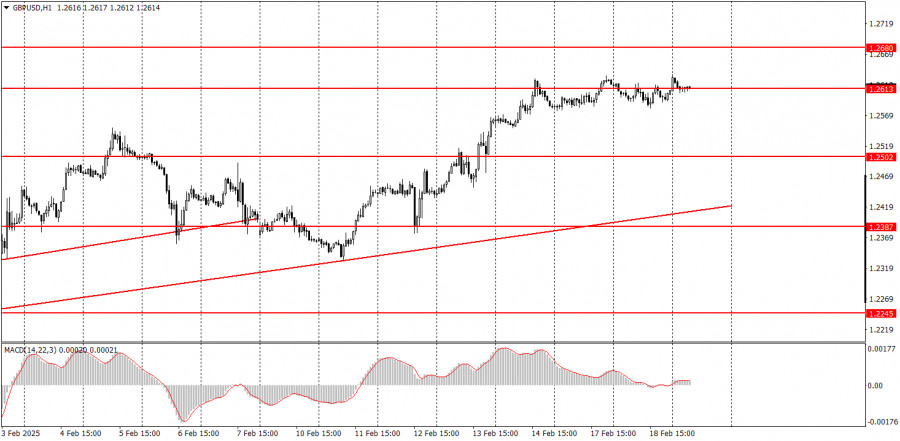

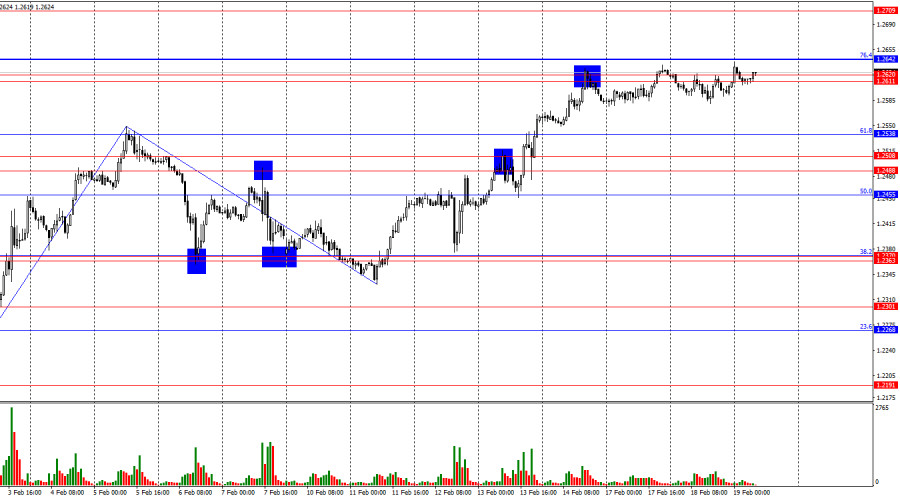

Fundamental analysisOverview of the GBP/USD Pair on February 19: The British Pound Has Also Exhausted Its Strength

The GBP/USD currency pair experienced a period of stagnation for most of TuesdayAuthor: Paolo Greco

05:19 2025-02-19 UTC+2

1243

- Trading plan

How to Trade the GBP/USD Pair on February 19? Simple Tips and Trade Analysis for Beginners

On Tuesday, the GBP/USD pair remained stagnant for the second consecutive dayAuthor: Paolo Greco

07:47 2025-02-19 UTC+2

1228

Fundamental analysisWhat to Pay Attention to on February 19? A Breakdown of Fundamental Events for Beginners

There are a few scheduled macroeconomic events for Wednesday, but several important reports will be releasedAuthor: Paolo Greco

08:06 2025-02-19 UTC+2

1198

Technical analysisTechnical Analysis of Intraday Price Movement of Platinum Commodity Instrument, Wednesday February 19, 2025.

If we look at the 4-hour chart of the Platinum commodity instrument, a Bearish 123 pattern appearsAuthor: Arief Makmur

07:26 2025-02-19 UTC+2

1183

- Trading plan

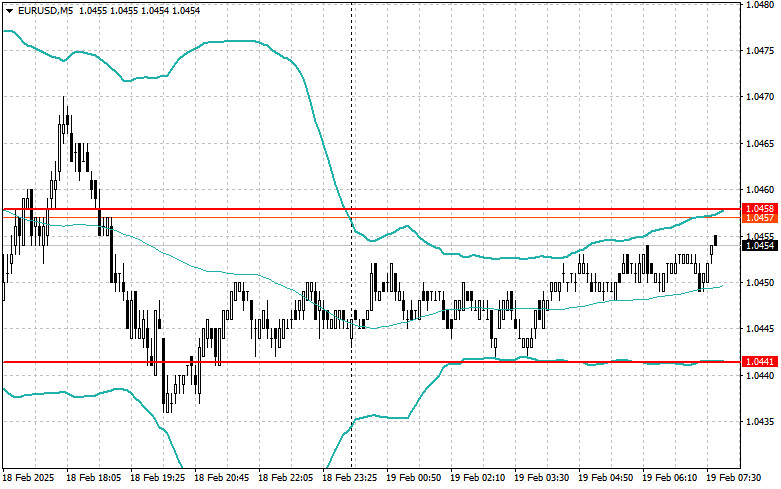

How to Trade the EUR/USD Pair on February 19? Simple Tips and Trade Analysis for Beginners

On Tuesday, the EUR/USD currency pair experienced minimal volatility and a downward biasAuthor: Paolo Greco

07:47 2025-02-19 UTC+2

1168

Bearish traders lack the necessary strengthAuthor: Samir Klishi

11:00 2025-02-19 UTC+2

1003

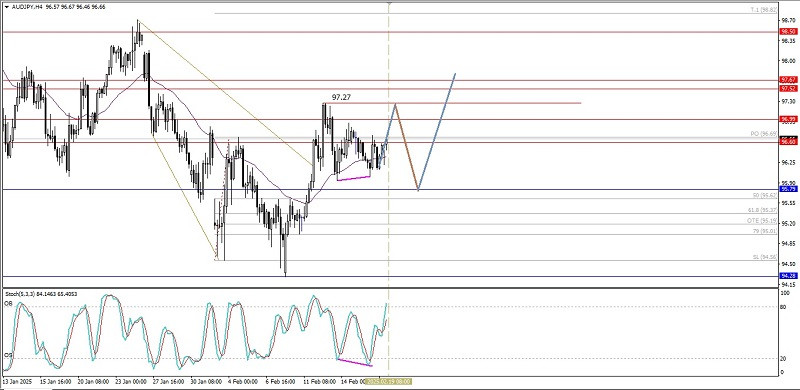

Technical analysisTechnical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday February 19, 2025.

With the appearance of Convergence between the price movement of AUD/JPY and theAuthor: Arief Makmur

07:26 2025-02-19 UTC+2

898

See also