昨日在加密峰會上,特朗普的演講後,比特幣和以太坊的壓力再次出現。另一個原因是美國股市上風險資產的新一輪拋售。最近,加密市場與股票密切相關,顯示出對美國經濟發展的更大依賴性。

市場參與者未能從特朗普的言論中獲得廣泛預期的支持,這引發了一波拋售潮,並且由於市場普遍緊張情緒而加劇。零售交易員擔心加密貨幣市場可能會進一步下跌,因此繼續拋售風險資產。

加密貨幣市場與美國股市之間的相關性表明數字資產越來越多地融入傳統金融系統。然而,這也使得加密貨幣更容易受到宏觀經濟因素和政治言論的影響,這無疑增加了投資者的不確定性。

從積極的方面來看,比特幣的需求目前達到了FTX崩潰後的水平,當時市場達到了底部。這表明機構投資者仍然對這個領域有信心,並且願意回歸,儘管波動性依然存在。越來越多的機構參與者將比特幣視為一種可以對沖與傳統市場相關風險的替代資產。各國的地緣政治不穩定和通脹壓力也促使人們尋求新的可靠的資本保值工具,而圍繞比特幣的不斷增長的基礎設施使這一切變得更容易和更可及。

儘管短期內仍面臨技術阻力,但比特幣的整體上升趨勢依然完好。近期的價格動態表明進一步上升的潛力,並支撐了其作為領先加密貨幣的地位。

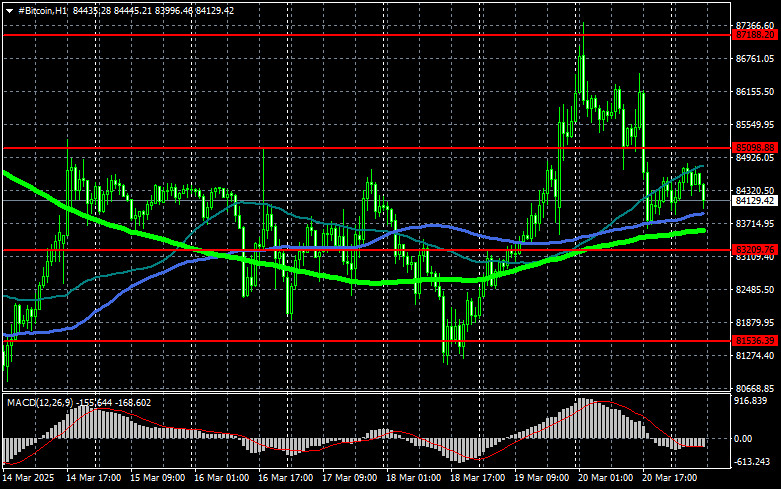

就比特幣的技術走勢而言,目前買家正著眼於重拾$85,000水平,這將為進一步上攻$87,100打開通路,隨後是略高於此的$89,400。最終目標是接近$91,900的高點——突破該水準將標誌著中期牛市的回歸。若出現下跌,預期支撐位於$83,200。跌破該點可能會迅速將BTC推向$81,500,最終看跌目標接近$79,700。

對於Ethereum來說,穩定保持在$1,989之上將開啟通向$2,027的道路。最終目標是靠近$2,082的年度高點——若突破這一點,也將表示回到中期牛市。如果Ethereum下跌,預計買家將在接近$1,954的水平出現。若回到此水準以下,可能會將ETH推向$1,917,最終空頭目標接近$1,871。

You have already liked this post today

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.