24.10.2022 09:27 AM

24.10.2022 09:27 AMAnalysis of transactions in the GBP / USD pair

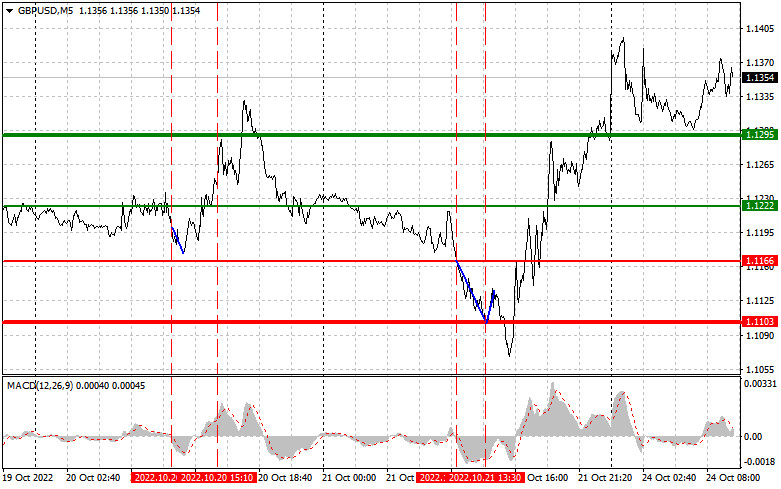

The test of 1.1166 happened when the MACD line was just starting to move below zero, which was a good reason to sell. It resulted in a price decrease of over 60 pips. Sometime later, the pair tested 1.1103, but this time, the signal was to buy, which led to a 20-pip rise. Pressure returned soon after.

The latest retail sales data in the UK was disappointing, as was the public sector leverage. This is why pound is trading downwards even at the time of writing.

Today, important statistics are due in the UK, both in the services and manufacturing sectors. If the data show a decrease, pound will fall down. Even the speech of Bank of England Deputy Governor Dave Ramsden will not affect the market. In the afternoon, similar reports are expected on the US, which could prompt a further rise in dollar, provided that the figures are at a more or less acceptable level. If, for some reason, the indices start to decline, pound will rise sharply.

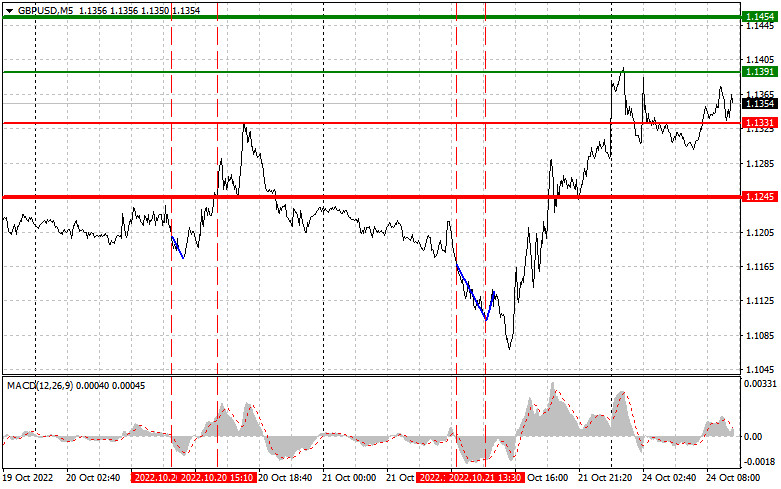

For long positions:

Buy pound when the quote reaches 1.1391 (green line on the chart) and take profit at the price of 1.1454 (thicker green line on the chart). Growth will occur if statistics in the UK exceed expectations. But remember that when buying, the MACD line should be above zero or is starting to rise from it.

Pound can also be bought at 1.1331, however, the MACD line should be in the oversold area as only by that will the market reverse to 1.1391 and 1.1454.

For short positions:

Sell pound when the quote reaches 1.1331 (red line on the chart) and take profit at the price of 1.1245. Pressure will return if data in the services sector indicate a slowdown or a decline. But take note that when selling, the MACD line should be below zero or is starting to move down from it.

Pound can also be sold at 1.1391, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1331 and 1.1245.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

英鎊交易分析與建議 當天上午測試了1.3294水平,當時MACD指標已顯著低於零線,限制了該貨幣對的下行潛力。因此,我沒有賣出英鎊。

下午測試1.1305水平時,MACD指標已經大幅低於零線,這限制了貨幣對的下跌潛力。因此,我沒有賣出歐元。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.