27.07.2022 01:39 PM

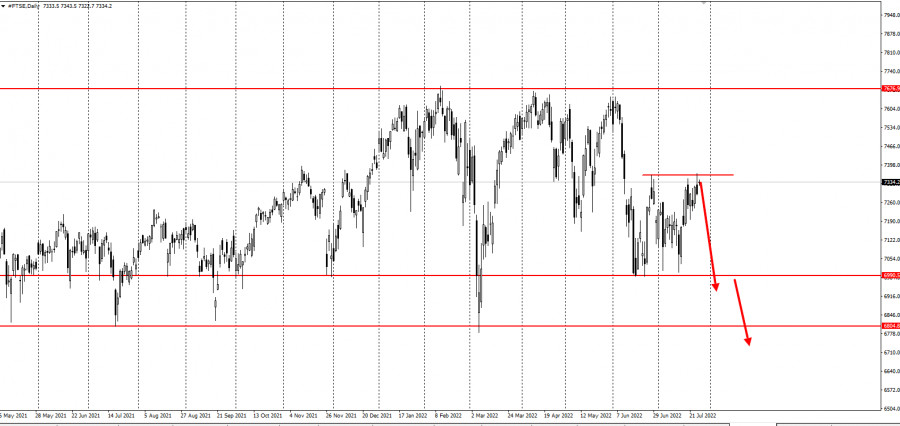

27.07.2022 01:39 PMThe International Monetary Fund said the UK will experience the slowest growth next year because of double-digit inflation and rising interest rates. Their latest outlook indicated that the global economy is currently fragile, so sliding into recession is possible. In fact, the FTSE 100 index already shows downside potential.

Accordingly, the IMF downgraded their rating for the UK in both 2022 and 2023, reflecting an increase in the forecast for peak inflation from 7.8% to 10.5%.

With regards to the battle over the seat of prime minister, Liz Truss accused her rival, Rishi Sunak, of pushing the economy into recession through tax increases. Sunak, meanwhile, accused Truss of planning to spur inflation, even though it is already at a 40-year high of 9.4%.

Sky-high inflation has eaten household incomes, causing poverty and the worst cost-of-living crisis in decades. The IMF said wage increases due to low inflation "undermine household purchasing power" and causes a slowdown in growth.

Bloomberg Economics estimates that the Truss tax cut will add 0.6% to 2023 GDP, pushing the UK's growth rate higher than that of France, Germany, Italy and the US. It would also add 0.4% to inflation, which will cause interest rates to rise by another 0.5%. Markets expect UK rates to hit 3%.

The biggest risks to global growth are inflation and rates, as well as the escalation of the war in Ukraine, which will drive up energy and food prices. A tight labor market will allow workers to earn higher payouts, while higher interest rates could lead countries to shrink.

The IMF has previously said that the UK faces a serious problem on inflation, linked both to high energy prices experienced by Europe and a shortage of jobs.

在四月,美國股市自疫情以來,給投資者帶來了最為波動的過山車之旅。白宮的「美國解放日」關稅似乎削弱了標普500指數的穩定性,將其推入熊市領域。

根據最新數據,儘管尚未完全感受到美國總統特朗普關稅的影響,歐元區經濟在年初增長超出預期。因此,昨天幾乎沒有理由慶祝或買入歐元。

週四的宏觀經濟事件相對較少,但這已經不太重要了。昨天,歐元區、德國和美國都有許多重要的數據公佈。

英鎊/美元貨幣對在星期三繼續小幅下跌。美國貨幣在星期一無明顯原因下損失了將近150點。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.