11.05.2022 01:49 PM

11.05.2022 01:49 PMUntil the ECB takes concrete steps towards tightening its policy, the euro will remain under strong pressure, and the EUR/USD pair is under threat of a new fall below 1.0500, towards euro parity with the dollar.

EUR/USD is declining not only due to the weak euro but also to the strengthening dollar.

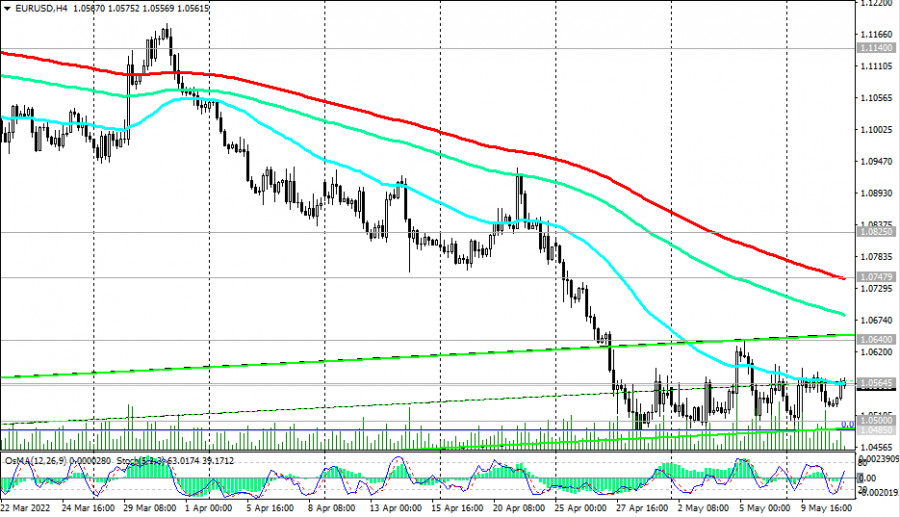

In terms of technical analysis, a strong negative impulse prevails. In particular, the Stochastic on the monthly chart of the pair has been in the oversold zone since October 2021, not wanting to leave there, which indicates a strong trend.

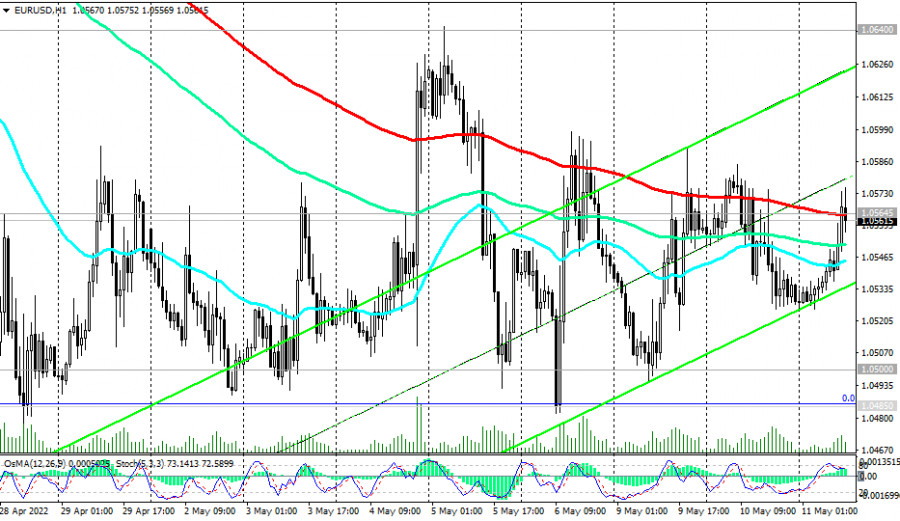

And yet, on the lower time frames (daily, 4-hour, 1-hour), technical indicators switched to the side of the buyers, signaling the possibility of continuing the upward correction.

Its immediate targets are resistance levels 1.0748 (200 EMA on the 4-hour chart), 1.0825 (50 EMA on the daily chart), and the signal for this upward movement will be a breakdown of resistance levels 1.0565 (200 EMA on the 1-hour chart), 1.0640 (local top).

In our previous review on 04/28/2022, we noticed that the price dropped to a strong support level of 1.0500, near which there were bounces three times (in February and November 2015, as well as in January 2017), and the price turned up. As a matter of fact, that is what happened.Nevertheless, further growth (above the resistance levels of 1.0748, 1.0825) is unlikely. Below the key resistance levels 1.1245, 1.1285, 1.1500, 1.1720, EUR/USD is in the zone of a long-term bear market, and "a breakdown of the support levels at 1.0500, 1.0470 will confirm our assumption" about further decline in the pair. In the current situation, short positions remain preferable.

Support levels: 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Resistance levels: 1.0565, 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285

Trading Tips

Sell Stop 1.0520. Stop-Loss 1.0610. Take-Profit 1.0500, 1.0470, 1.0400, 1.0350, 1.0300

Buy Stop 1.0610. Stop-Loss 1.0520. Take-Profit 1.0640, 1.0700, 1.0748, 1.0800, 1.0825, 1.0900, 1.1000, 1.1140, 1.1245, 1.1285

週二,英鎊/美元匯率在週一再次急升後出現了下跌修正。無論是在週一還是週二,都沒有任何基本面或宏觀經濟的原因支持這些波動。

在星期二,英鎊/美元貨幣對未能延續星期一開始的強勁上升趨勢。值得注意的是,本周初英鎊上漲或美元下跌並沒有實質的理由。

在整個星期二,EUR/USD 貨幣對繼續在盤整通道內波動。從上面的圖表中可以看出平穩的走勢。

在我早上的預測中,我強調了1.3421這一水平,並計劃基於此做出交易決策。讓我們看看5分鐘的圖表,看看發生了什麼。

在我上午的預測中,我注意到了1.1378這一水平,並計劃基於此做出交易決策。我們來看一下5分鐘圖表並分析發生了什麼。

週一,儘管沒有基本面的理由,英鎊/美元貨幣對再次上漲。然而,到現在為止,所有交易者應該已經習慣了這類情況。

图形图案

指标。

注意事项

您永远不会!

InstaForex俱乐部

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.