#PEP (PepsiCo Inc.). 汇率和在线图表。

货币转换器

10 Apr 2025 22:59

(-0.01%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

PepsiCo Inc. (#PEP) is a world’s leading multinational food and beverage corporation. The company was founded in 1965 in the US. It is the second largest corporation in the global food business in terms of net revenue.

PepsiCo produces and sells fizzy and still drinks, snacks, and other products in the US and around the world. The company owns several popular brands such as Pepsi, 7Up, Gatorade, Tropicana, Lay’s, Cheetos and others. At present, the company is committed to healthy nutrition, thus reducing dubious ingredients in its products.

In the 2008 fiscal year, PepsiCo revenues surged 9.6% to $43,251 billion whereas net profits on the contrary slumped 9.1% to $5,142 billion. Nowadays, its market capitalization equals $9,773.06 billion.

PepsiCo is included in the S&P 500 index. The company’s shares are traded on the NYSE under the #PEP ticker. In 2017, 99.57% of PepsiCo shares have been in free circulation.

The global producer of soft drinks and snacks suggests lucrative investment opportunities. According to expert estimates, PepsiCo’s shares gain 1.54% on average per month.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

823

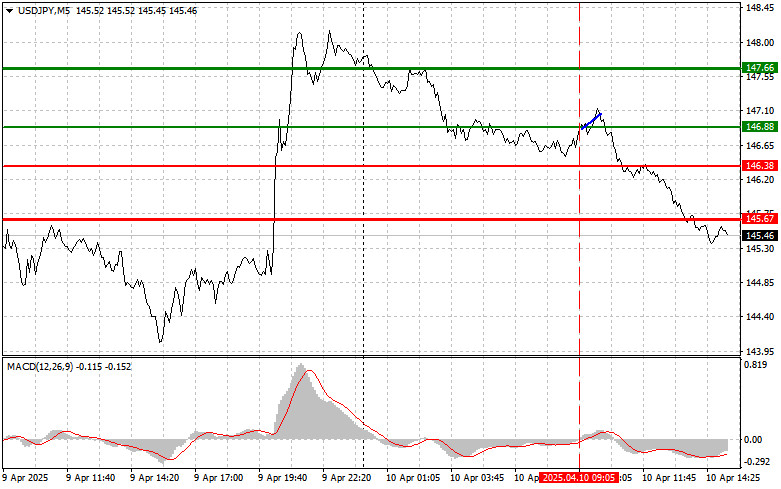

USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)Author: Jakub Novak

20:19 2025-04-10 UTC+2

793

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

748

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

718

On Thursday, the EUR/USD rate rose by 120 basis points.Author: Chin Zhao

20:24 2025-04-10 UTC+2

703

Euro hits first reversal level—may reverse or push to second levelAuthor: Laurie Bailey

05:03 2025-04-11 UTC+2

703

- Fundamental analysis

Trading Recommendations and Analysis for GBP/USD on April 11: The Dollar Takes a Double Hit

The GBP/USD currency pair also showed strong growth on Thursday, although not as strong as the EUR/USD pairAuthor: Paolo Greco

03:28 2025-04-11 UTC+2

688

Pound considers further growthAuthor: Laurie Bailey

05:03 2025-04-11 UTC+2

673

The published U.S. CPI report landed in the "red zone," reflecting a slowdown in inflation. However, given recent events, the relevance of this release is highly questionable.Author: Irina Manzenko

00:47 2025-04-11 UTC+2

643

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

823

- USDJPY: Simple Trading Tips for Beginner Traders – April 10th (U.S. Session)

Author: Jakub Novak

20:19 2025-04-10 UTC+2

793

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

748

- Today, gold maintains a positive tone, trading above the $3100 level.

Author: Irina Yanina

20:05 2025-04-10 UTC+2

718

- On Thursday, the EUR/USD rate rose by 120 basis points.

Author: Chin Zhao

20:24 2025-04-10 UTC+2

703

- Euro hits first reversal level—may reverse or push to second level

Author: Laurie Bailey

05:03 2025-04-11 UTC+2

703

- Fundamental analysis

Trading Recommendations and Analysis for GBP/USD on April 11: The Dollar Takes a Double Hit

The GBP/USD currency pair also showed strong growth on Thursday, although not as strong as the EUR/USD pairAuthor: Paolo Greco

03:28 2025-04-11 UTC+2

688

- Pound considers further growth

Author: Laurie Bailey

05:03 2025-04-11 UTC+2

673

- The published U.S. CPI report landed in the "red zone," reflecting a slowdown in inflation. However, given recent events, the relevance of this release is highly questionable.

Author: Irina Manzenko

00:47 2025-04-11 UTC+2

643