#V (Visa Inc.). Exchange rate and online charts.

Currency converter

16 Apr 2025 22:59

(-0.12%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Visa Inc. is an American corporation which deals with payment technologies. The company provides card holders, financial institutions, firms, and public agencies with access to electronic payments in over 200 countries worldwide. The company’s services include processing of transactions, digital products, payment products, and payment security. The corporation offers three types of cards: debit, credit, and prepaid cards. Importantly, Visa does not issue cards and does not set rates and fees for customers. It provides financial institutions with payment products which firms use to offer their clients credit, debit, prepaid, and cash-access programs.

The company owns and operates widely recognized payment brands such as Visa, Visa Electron, PLUS, and Interlink. So customers use Visa-branded cards in their payment programs. In 2015, the Nilson Report, a periodical that focuses on the credit card industry, found that Visa’s global network processed 100 billion transactions with total worth of $6.8 trillion.

The company’s origin dates back to 1958 when Bank of America launched its BankAmericard. Amid growing popularity, BankAmericard Service Corporation was established which supervised transactions via such cards and sold licenses for their issue. However, Visa Europe, an independent company from Visa Inc., was operating in Europe at that time. Visa Inc. decided to acquire Visa Europe to create a single global company. Visa Inc. was founded as a separate company in October 2007 with the headquarters in San Francisco, California. It comprises four branches: Visa U.S.A., Visa International, Visa Canada, and Inovant. In Europe, Visa is owned and managed by banks belonging to Visa International Service Association. The headquarters of Visa Europe are situated in London, the UK.

Starting from the winter Olympic Games in 1998, Visa has been retaining the exclusive right to be the only electronic payment system accepted for payments throughout all Olympic villages. Visa Inc. has been a sponsor of the most important football tournaments in South America. Having replaced MasterCard, Visa became the main sponsor of the 2010 FIFA World Cup in South Africa. Besides, Visa has been the exclusive sponsor of elite horseracing tournaments.

The net profit in Q1 2017 surged 7% to $2.1 billion compared to the same quarter a year ago. Besides, net operating profits skyrocketed 25% to $4.5 billion.

87.10% of the company’s shares are traded on the New York Mercantile Exchange and other trading floors around the world. Visa shares are among the best performing global stocks. The price of Visa shares is one of 30 components which are used to calculate the Dow Jones Industrial Average. Therefore, the shares of the prosperous company are a good idea for lucrative investments.

See Also

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1318

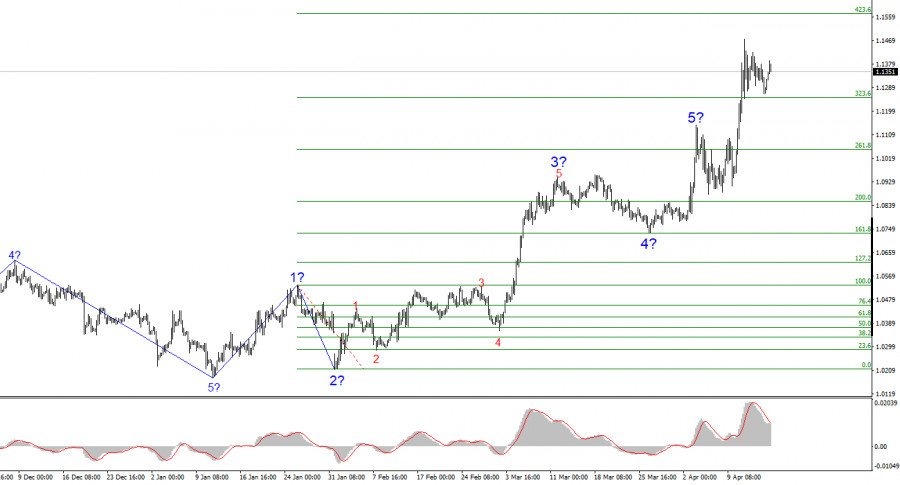

The EUR/USD pair rose by several dozen points during Wednesday's session.Author: Chin Zhao

18:56 2025-04-16 UTC+2

1303

Technical analysis / Video analyticsForex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- Type of analysis

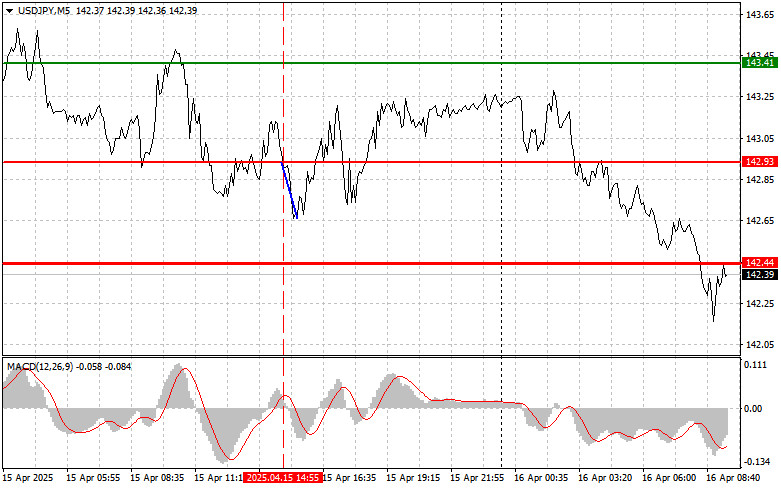

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

USD/CHF. Analysis and ForecastAuthor: Irina Yanina

11:41 2025-04-16 UTC+2

1003

Trading Recommendations for the Cryptocurrency Market on April 16Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

988

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

Fundamental analysisConfrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

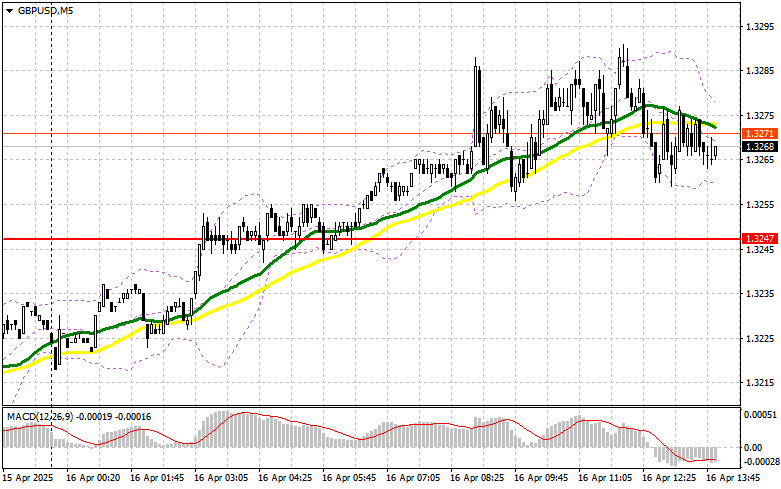

Trading planGBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

898

- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets.

Author: Irina Yanina

11:50 2025-04-16 UTC+2

1318

- The EUR/USD pair rose by several dozen points during Wednesday's session.

Author: Chin Zhao

18:56 2025-04-16 UTC+2

1303

- Technical analysis / Video analytics

Forex forecast 16/04/2025: EUR/USD, GBP/USD, USD/CAD, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CAD, Oil and BitcoinAuthor: Sebastian Seliga

09:55 2025-04-16 UTC+2

1123

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:46 2025-04-16 UTC+2

1123

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

11:41 2025-04-16 UTC+2

1003

- Trading Recommendations for the Cryptocurrency Market on April 16

Author: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

988

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor sentiment. While the banking sector posted gains, buoyed by strong earnings from major players, it was not enough to.

Author: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

943

- Fundamental analysis

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Confrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)Author: Pati Gani

11:34 2025-04-16 UTC+2

913

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)

GBP/USD: Trading Plan for the U.S. Session on April 16th (Review of the Morning Trades)Author: Miroslaw Bawulski

18:31 2025-04-16 UTC+2

898