US market could fall another 20%, BlackRock's Fink warns

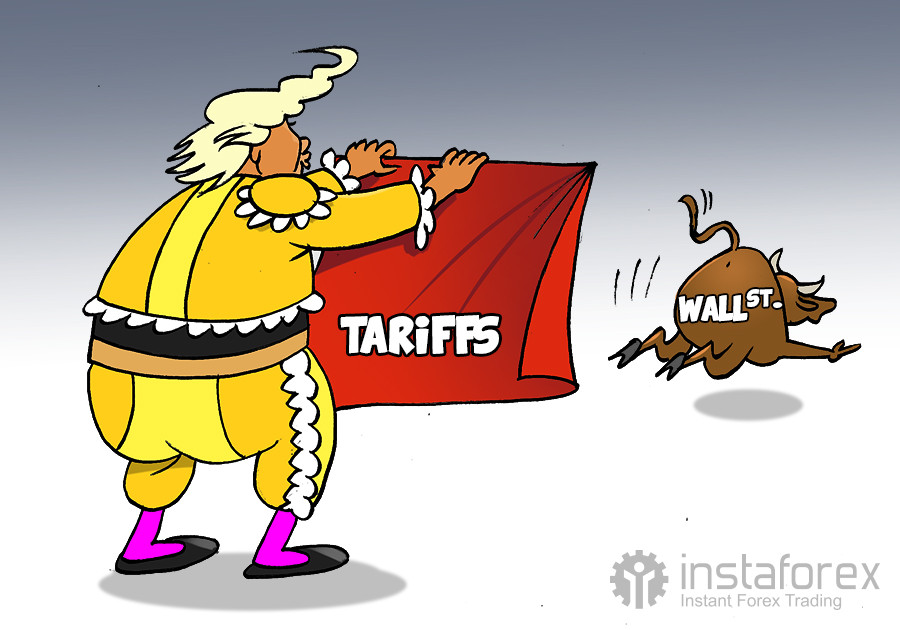

The US stock market may be headed for a deeper decline. BlackRock CEO Larry Fink has issued a stark warning, suggesting that equities could fall another 20% amid President Donald Trump's sweeping tariff campaign. With markets already rattled, Fink believes it is time to hit the brakes before the economic fallout snowballs further.

According to Fink, Trump's wide-ranging tariffs on nearly all imported goods could trigger a sharp market downturn. The head of the world's largest asset manager predicts a potential 20% drop from current levels, calling the impact of the US administration's trade policies potentially disastrous.

Fink noted that many corporate leaders now believe the US economy has already entered a recession and expect conditions to deteriorate further. Tariffs could inflame inflation by making foreign goods more expensive, he said, warning of a dangerous spiral for both consumers and investors.

Still, the BlackRock chief does not see the current correction as catastrophic, at least not yet. He believes the stock market will eventually recover in the long run. The bigger risk, he argues, is that the US could lose its status as the conductor of the global financial system, a role that underpins its influence and investor confidence.

According to the expert, 62% of Americans now invest in stocks. This means that market volatility is no longer just a Wall Street issue — it is affecting households across the country. Continued volatility could weigh heavily on consumer spending, dealing an additional blow to US economic growth.

President Trump, however, seems unfazed by these warnings. According to Bloomberg, citing unnamed sources, the president is growing increasingly indifferent to criticism and has shown little interest in changing course. Politico reports that Treasury Secretary Scott Bessent recently attempted to intervene, urging Trump to more clearly explain the rationale and long-term goals of the tariffs. Bessent appears to be alarmed by the market decline and concerned that the situation could get worse.